Welcome to ClaimsSnap

ClaimsSnap is a powerful, simple, and flexible application that makes it easy for you to manage claim payments to your insureds💰; both businesses and people!

This API empowers you to send payments in the way that works best for your claims team. You have powerful options at your fingertips:

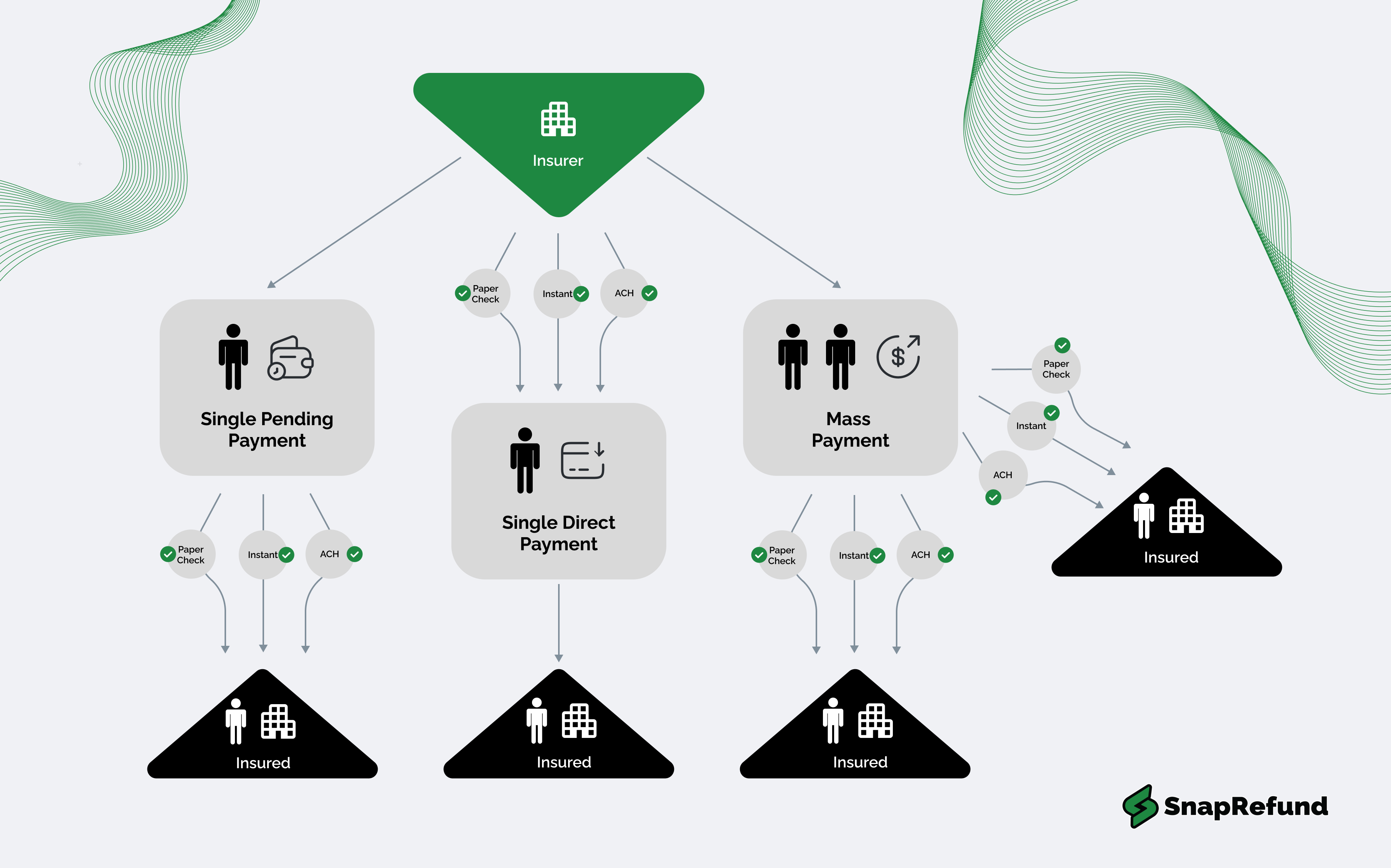

Wow, what a beautiful graphic 🤩.

Let's take a look at the which style of payments makes the most sense for your claim payment operations!

- Single Pending Payments - Great for sending individual claim payments one at a time

- Send a Pending Payment link to one insured at a time with POST /api/public/payments

- Advantages:

- You don't need to know your insured's banking info. They enter any necessary information themselves during cash-out

- All you need is your insured's email address to use this endpoint (and how much you want to pay them of course 🙂)

- Considerations:

- Your insured needs to take an action to trigger their payment;

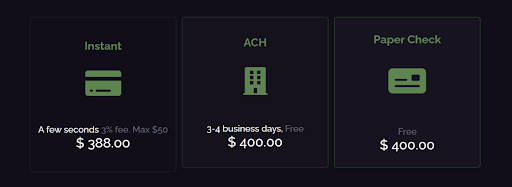

- The link will redirect your insureds to the ClaimsSnap web-app where they can quickly cash-out their claim by choosing one of your supported payment methods, like so

- Advantages:

- Send a Pending Payment link to one insured at a time with POST /api/public/payments

- Single Direct Payments - Good for controlling the payment method your insured will receive their claim payment with

- Sends a payment directly to your insured's bank account or mailing address via the digital payment or paper check endpoints

- Advantages:

- Your insured doesn't need to do anything to get paid. Literally, they can just sit on the couch watching TV while the payment automatically reaches their bank account or physical mailbox with zero actions taken

- You decide which payment method to transmit the payment through

- Considerations:

- You need to know your insured's bank routing and account numbers, or mailing address (for paper checks), to send them a Direct Payment

- Mass Payments - good for sending a lot of claim payments at once

- We offer the ability to send many Pending Payments at once to a multitude of insureds via a csv upload on your team's ClaimsSnap dashboard

- Advantages:

- You can send thousands of Pending Payments all from a single spreadsheet upload:

- You can download the spreadsheet template by navigating to Send Payment -> Download the CSV template

- Just like with single Pending Payments, your insureds will receive an email link that redirects them to a cash-out page where they can choose which of your supported payment methods to receive their claim payment with

- You can send thousands of Pending Payments all from a single spreadsheet upload:

- Considerations:

- Mass Payment spreadsheets have to be parsed and batched by our server, so you'll have to wait while the file is being processed

- If you don't follow the template for the data entries into the spreadsheet template you download some of your payments will be unsuccessful

ClaimsSnap currently supports the following payment methods:

- ACH (3-4 business days)

- Paper Check:

- USPS Regular (7-10 days)

- USPS First Class (3-5 days)

- USPS Priority (1-3 days)

- FedEx Next Day (1 day)

- Other payment rails available upon request, like RTP®

ClaimsSnap's modern payment API simplifies account-to-account (A2A) payments, empowering insurance companies to automate money movement, significantly reducing processing times and improving profitability. Our payment API also connects to the physical world by providing a paper check mailing service, equipped with a multitude of shipping speeds and tracking options to ensure that you stay compliant with relevant insurance regulations and support all of your insureds, even those without bank accounts.

ClaimsSnap also leverages Plaid's secure service to act as an intermediary link between your bank account and our financial application. When you and your insureds link your external bank accounts to ClaimsSnap via Plaid, Plaid takes the account credentials you provide, encrypts any financial data requested (such as an account-holder's identity), and then supplies it back to ClaimsSnap through a secure connection.

Updated about 2 months ago